For years we were content with paying cash for flights and hotels while enjoying cash back offered by a handful of credit cards. Last year we decided to focus more on travel cards and maximizing rewards programs. What prompted us to make the switch? It was the culmination of many factors that led us to the realization that we could utilize rewards programs to better meet our goals.

- Family travel is expensive: Our travel budget took a major hit once we no longer had lap children.

- Redeeming cash back is getting harder: Our credit cards (nearly simultaneously) made it more difficult to redeem cash back via restrictions and higher fees.

- Being a frequent flyer no longer means free flights: Despite flying more often for work trips, we were far away from being able to cash in on any of those accumulated miles.

- Rewards programs increase markups: The high costs of competitive rewards programs are passed on to customers via (often hidden) markups on everyday prices.

- Choosing between costs and happiness: On multiple occasions we chose to skip big events and alter family vacation plans due to the high costs of travel.

Expensive Family Travel

Once both our kids hit that magical age of 2, our flight costs doubled. Upon seeing our total vacation expenses at the end of the year, my wife asked “did we even go anywhere?”. Eight roundtrip flights during peak season to visit relatives pretty much exhausted our vacation budget for the year. Rewards programs can help us offset those additional costs in a variety of ways.

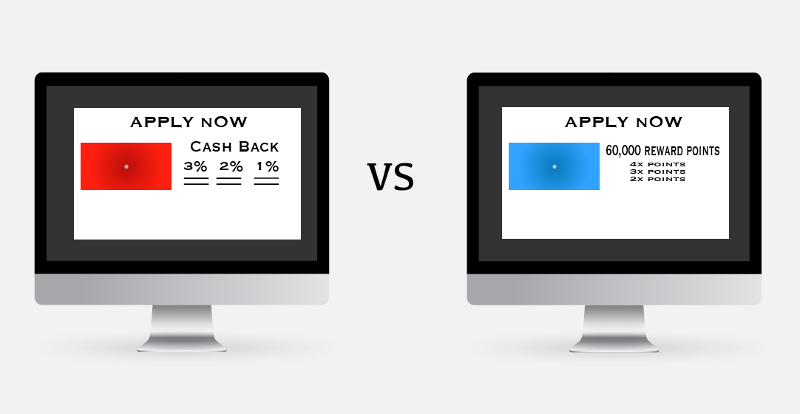

Additional Restrictions on Cash Back Cards

Cash back credit cards used to earn all of our swipes, with a baseline of 2.5% back thanks to the Alliant Signature Visa card. Then Alliant increased the annual fee to $99 and (following the cash back trend) added a maximum earning per period as well as minimum redemption amount. Using no annual fee 2% cash back cards (e.g. Citi Double Cash and Alliant Visa Platinum Rewards) as a baseline, we now need to spend nearly $20,000 per year just to break even on the additional 0.5% cash back.

Other cards added additional restrictions how the cash back could be redeemed (typically only allowing statement credits, with Uber converting to a rewards program allowing only Uber cash redemptions). Many rewards programs offer more flexibility in terms of redemption options that we could better utilize to meet our goals.

Devalued Frequent Flyer Miles

I spent a few years traveling across the country (and most recently – until Covid – the pond) a few times per year for work. While being away from the kiddos due to work was never too enticing, we initially thought a silver lining would be the frequent flyer miles that came with it. We had dreams of using those miles for fun addon trips.

After four years of flying, United thanked me with a ceremonious label of “Premier Silver” status, but we were still far away from having enough miles to bring the family along. This was a major deviation from my frequent flyer experience in college, when Southwest would just shove free flights in my face for virtually every “Wanna Get Away” fare I booked.

We learned that the increased availability of miles via credit card rewards have significantly devalued miles earned from actual flying. If we want to properly take advantage of these programs, we need to earn miles in the way that brings the most value.

Rewards Programs and the Social Security of Travel

As rewards programs continue to compete for customers, the cost of maintaining those programs is also rising. While explicit surcharges may be illegal and/or frowned upon, those costs are ultimately passed on to customers via (often indirect) markups on everyday prices as businesses strive to maintain margins.

Markups are most evident with businesses that offer a separate cash and credit card price for the same items (the only difference being the processing fees), as well as the new Basic Economy fad that has hit the airlines (“basic” meaning you give up your right to a percentage of frequent flyer miles, among other freedoms).

This is the social security of travel; everyone is paying into the system with every purchase, but only those utilizing rewards programs are benefitting from it. We decided to take back our portion of those markups by maximizing our rewards from these programs.

Prioritizing Happiness and Spontaneity

Both my wife and I have some of our fondest childhood memories from family vacations, and we hope to provide the same incredible experiences for our own children. However, with our cash back rewards mostly restricted to statement credits, it is easy for us to lose focus on saving for the greater experiences. On multiple occasions we chose to skip big events and alter vacation plans due to the high costs of travel.

We intend to invest in rewards programs (especially those with transferrable points) to help us prioritize family vacations and take advantage of spontaneous events that are otherwise too expensive due to travel costs. The next time Northwestern makes it to the Rose Bowl, our entire family will be there to see it live.